Introducing Global Bank's AI-Driven Financial Suite

Revolutionising banking with predictive analytics for accurate credit scoring and dynamic pricing models. Experience smarter, faster, and more personalized financial services through cutting-edge technology.

Navigating Credit Inclusion, Market Competitiveness, and Regulatory Complexity

Global Bank is confronted with multiple challenges that impact its operations and strategic objectives. Primary among these are the inclusion of underserved markets and the limitations of traditional credit scoring systems, which often exclude potential customers with thin or non-existent credit histories.

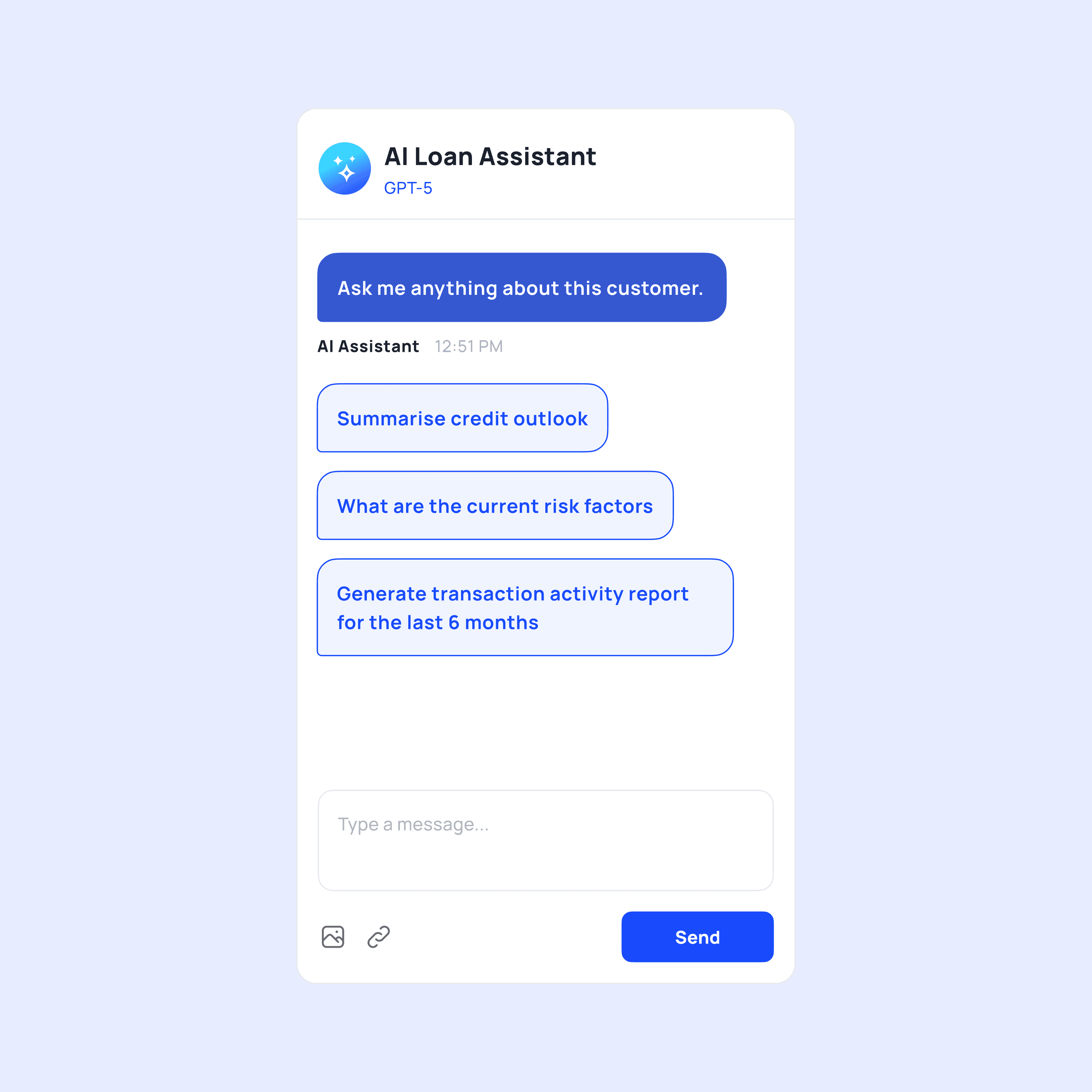

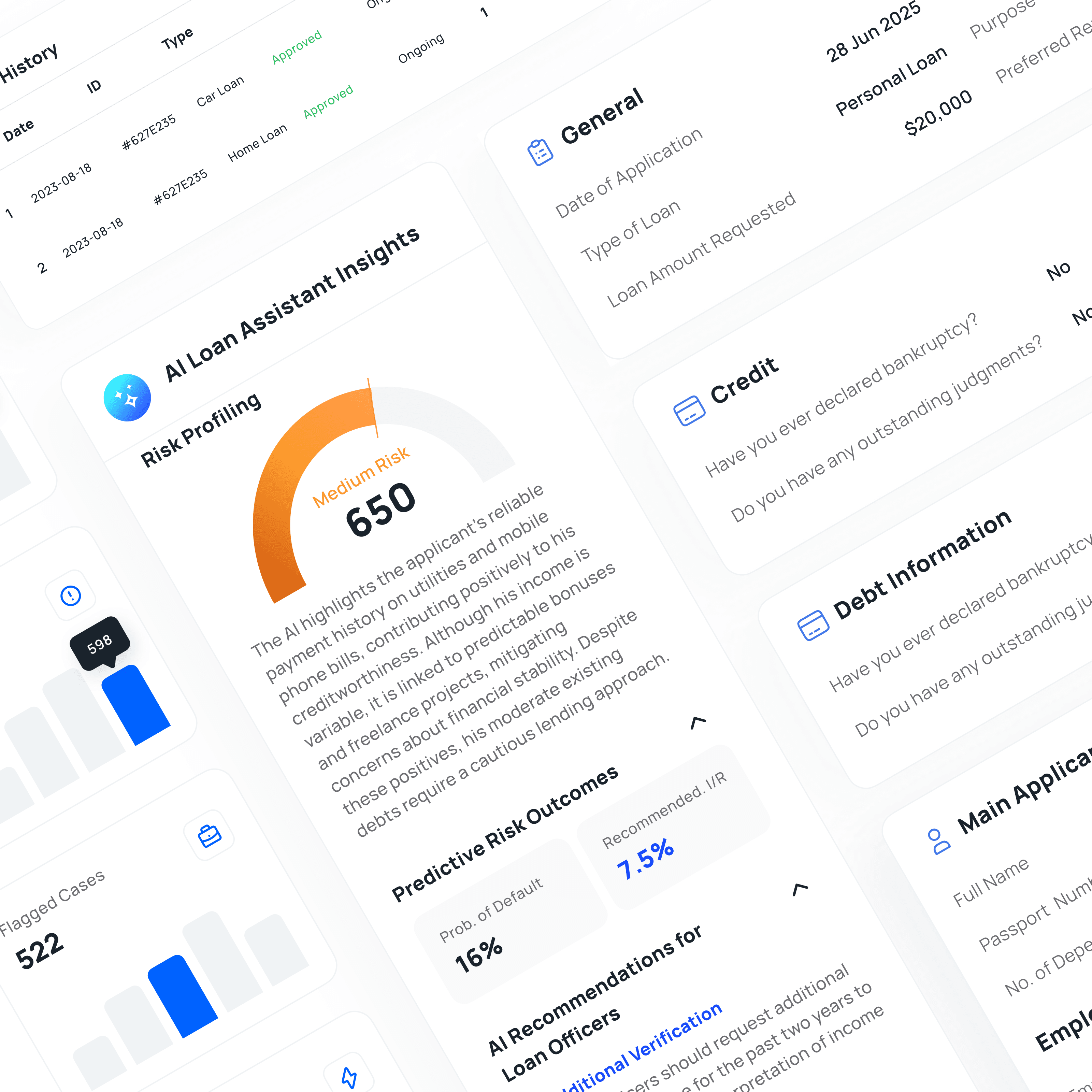

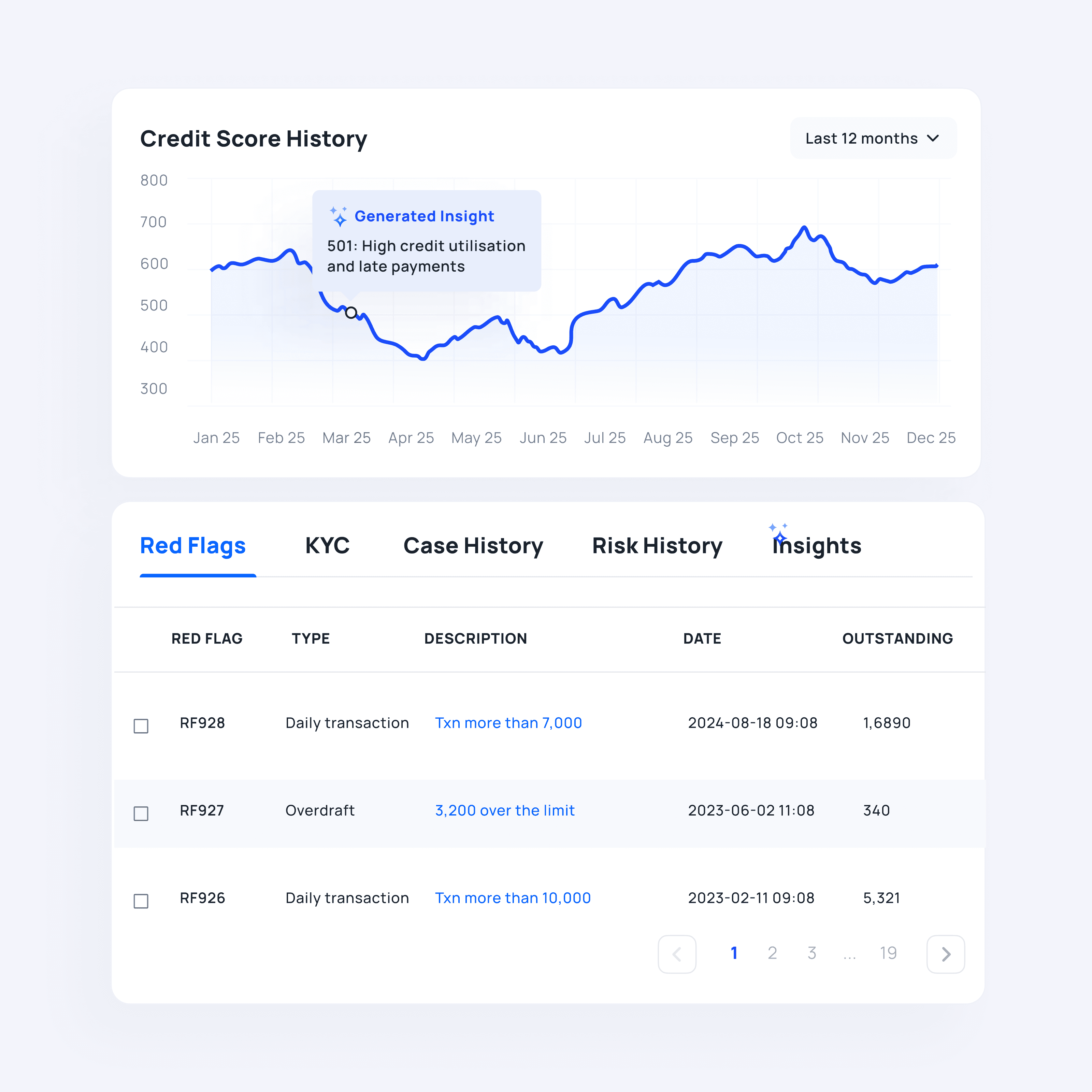

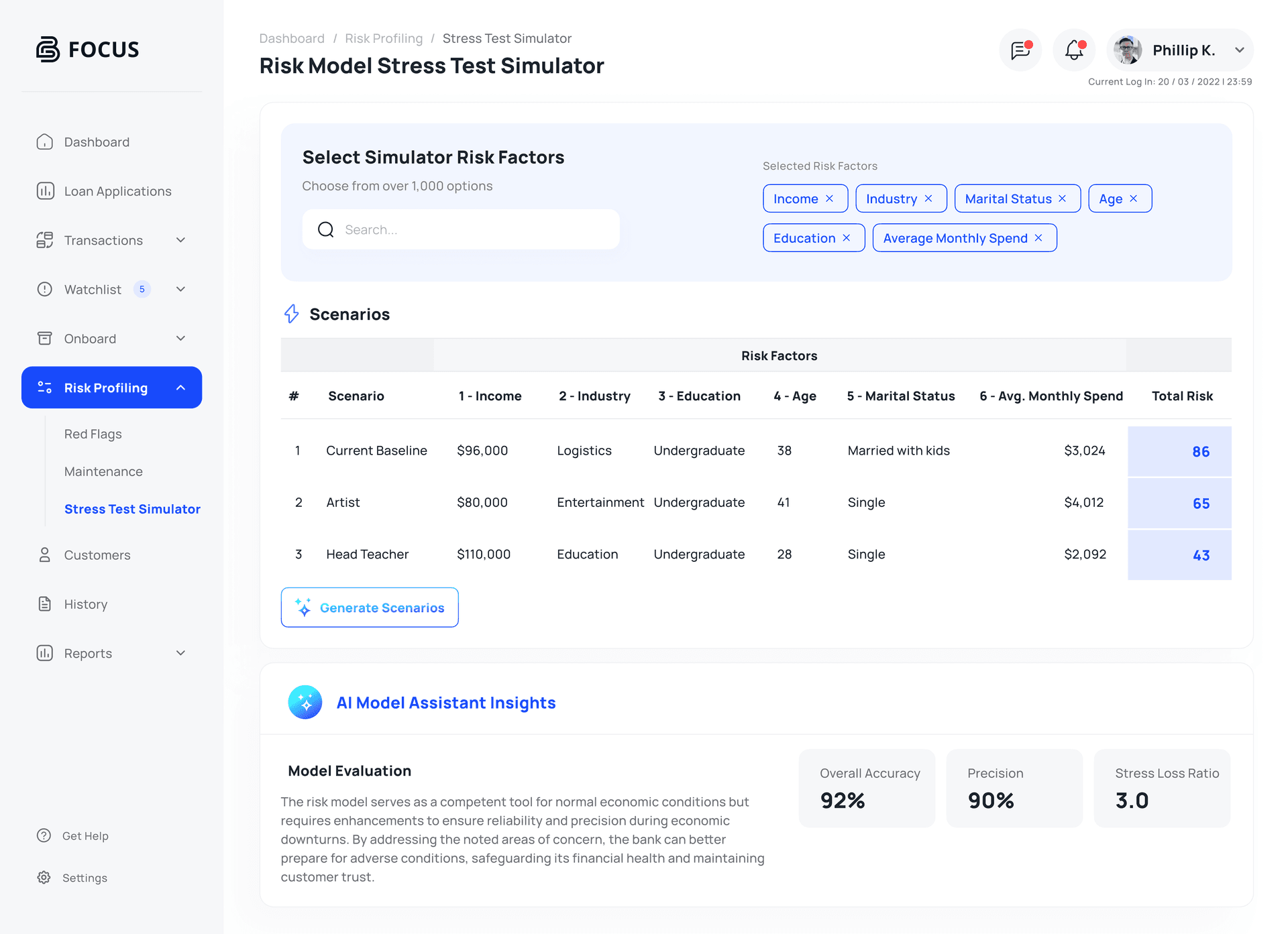

Global Bank's Advanced AI Solutions Transform Financial Services

This suite features a predictive analytics model that integrates various data sources for detailed credit assessments, a dynamic pricing system that adjusts loan rates based on real-time market data and borrower profiles, and a Risk Model Stress Test Simulator for scenario-based risk analysis. These innovations enhance credit scoring precision, pricing flexibility, and risk management, significantly expanding the customer base and ensuring strict regulatory compliance globally.